She will receive a yearly interest of Rs. Therefore he will have to pay 20 of Rs80000 which is Rs16000.

In The Matter Of Interest Crowe Malaysia Plt

So the deduction on her interest income.

. Individula is entitled to the exemption once in a lifetime. When the interest income from all your FDs is more than Rs. This limit has been increased to Rs 40000 in Budget 2019.

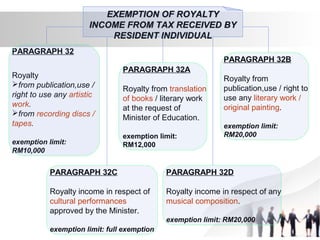

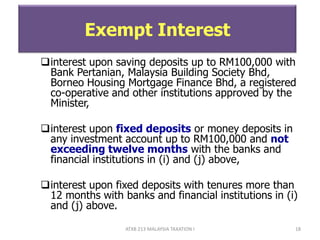

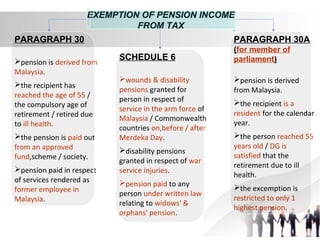

For example the interest you earn off a fixed deposit or certain dividend payments are fully exempted from income tax. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. 40000 a TDS deduction of 10 will become applicable.

However for fixed deposits you are only advised to. However if you dont submit your PAN. Income that you dont need to pay taxes for.

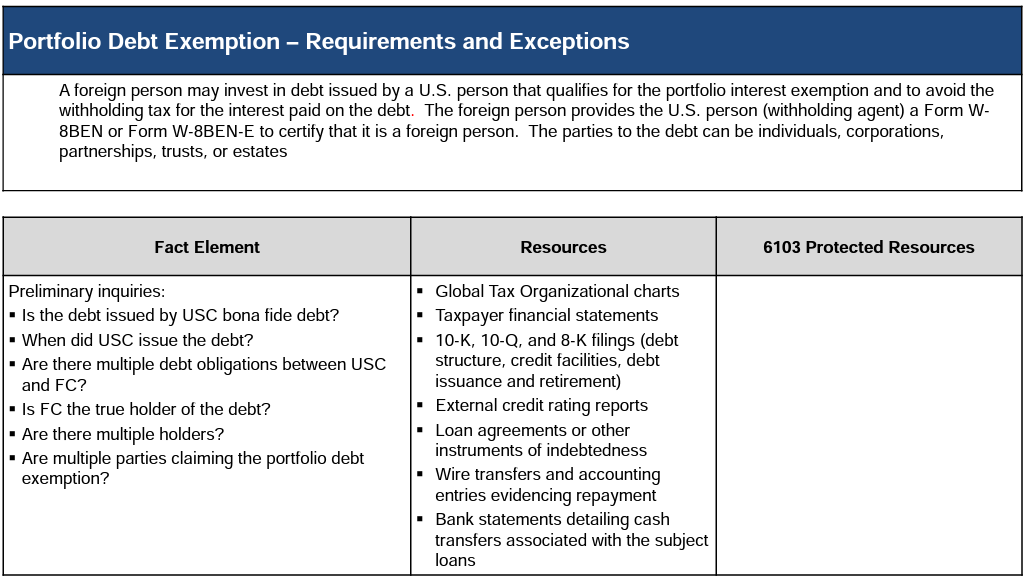

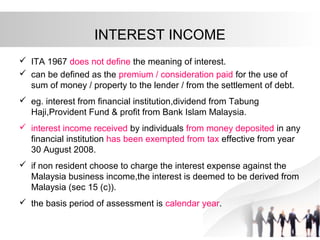

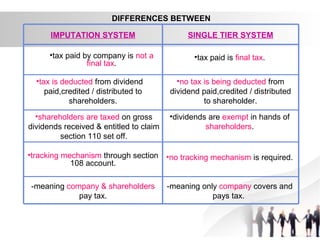

Dividends The following dividends are exempt form tax. Hence the balance amount of tax to be paid by. Tax treatment of interest expense 1 - 3 6.

Income from employment exercised in Malaysia for short-term visiting non-resident employees other than public entertainers if the period of employment does not exceed 60 days in a calendar year. The interest is added to taxable income for calculation of taxes. For example if you take up a job while overseas and you only receive the payment for the job when you are back in.

Fixed deposit also known as FD in Malaysia is an account that promises the investor a set rate of interest in return. The difference between a conventional savings account and a FD account is clear. Depending on the terms and conditions of the fixed deposit contract.

A private residence is defined as a building or part of a building in Malaysia owned by an individual and occupied or certified fit for occupation as a place of residence. 40000 is the threshold from all your fixed deposits. Tax Deductible at Source Tax ranging from 20-30 is charged for the people belonging to.

If interest is paid for a deposit which has not reached its maturity date the accrued interest is for the period for which the interest is paid. This scheme comes with certain drawbacks and they are as follows. 10 lakh with an interest rate of 7 per annum.

But if PAN details are not provided TDS 20 is deducted from the interest income. 45000 for the year your TDS would be Rs. For conventional savings accounts you are able to withdraw money at any time.

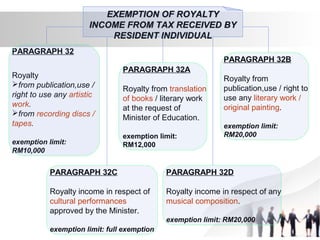

There are no premature withdrawals loans or overdraft OD facilities for tax-saving FDs. Interest expense incurred on investments 8 - 17 9. Refinancing loan 17 - 18 10.

Regular Fixed Deposits provide a loan facility. The Securities Commission Malaysia requires at least 90 of the net asset value NAV of a retail money market fund to be invested in short-term bank deposits of less than six months fixed deposits FDs of more than six months commercial paper and short-term corporate bonds with maturities of not more than a year. 14 Income remitted from outside Malaysia.

Deferred payment credit 19 11. According to Section 194A of the Income Tax Act TDS is applicable to the interest earned on fixed deposits. Your bank cannot deduct TDS when your interest income from all Fixed Deposits is less than Rs.

Tax on Interest The interest earned on investment is taxable. Interest restriction under subsection 332 of the ITA 3 - 7 7. Non-application of subsection 332 interest restriction 7 - 8 8.

The other 10 can be invested in. TDS on Fixed Deposits. The rate of tax deduction at source is 10 if the income from interest for each year exceeds Rs 10000.

Mrs Sharma has a fixed deposit of Rs. As stated before the deductible tax on fixed deposit interest is 10 per cent so for instance if you have earned an interest of Rs. A TDS of 10 is deducted by the bank on the income earned from interest which is Rs8000.

An investor can claim income tax exemption on investments up to Rs 15 lakh when investing in Fixed Deposits. Limitations of Investing in Tax Saving Fixed Deposit. Dividends received from exempt accounts of.

As part of a Tax Saving Fixed Deposit interest earned is taxable which is deducted at source. Treatment of interest expense attributable to dividend income. Exemptions and concessional tax treatment for expatriates.

Exemption is granted on gain derived from disposal of a private residence. The interest earned on the Term Deposit is Rs80000. Interest earned from a unit trust which is derived from Malaysia and paid or credited by any bank or financial institution licensed under the Banking and Financial Institution Act 1989 BAFIA 1989 or the Islamic Banking Act 1983.

If the period of. The bank will make a TDS deduction of 10. Here are a couple of examples to help you have a clear idea about the calculation of income tax on interest on fixed deposits.

This type of income is excluded from counting as your taxable income. In case of fixed deposits the bank or financial institutions deduct tax at source at the end of each year when the interest is paid by them. Thus the date of interest accrued for the purpose of income tax is the last day of the period set out in each case.

The tax deductible on your fixed deposits is on the interest. When your bank does not have your PAN details 20 TDS will be deducted from the. Exemptions or concessions are given in certain situations such as.

Manish will also have to pay interest earned on the tax rate equal to the gross income. TDS 10 is deducted if interest income exceeds Rs 40000 Rs 50000 for resident senior citizen during the financial year. 40000 in a certain financial year as per Budget 2019.

Individula is entitled to the exemption once in a lifetime. On the other hand if you have earned less than Rs 40000 for the year as interest Rs.

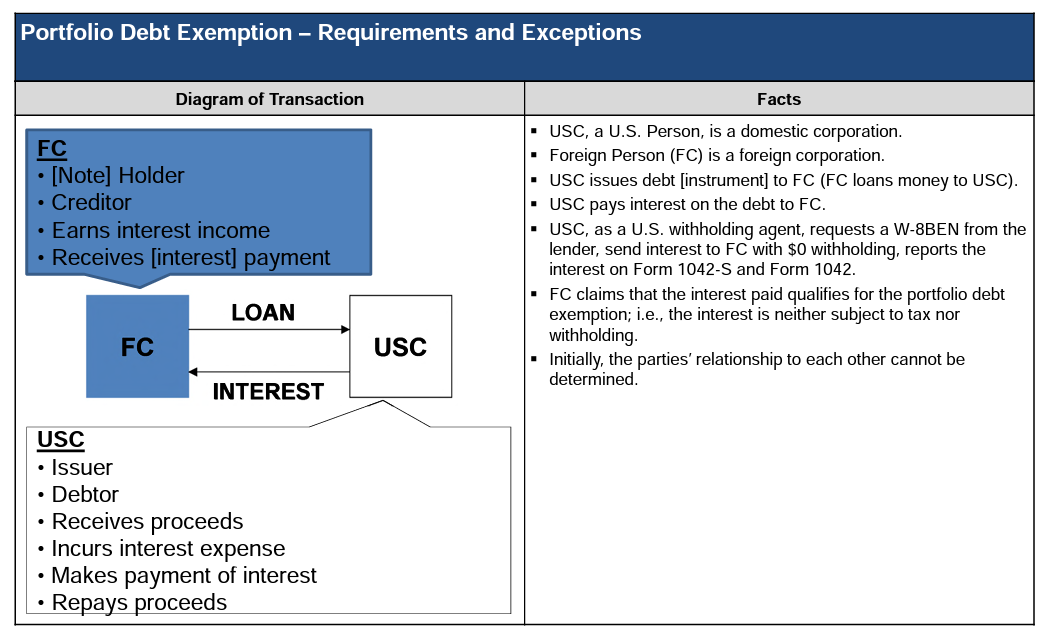

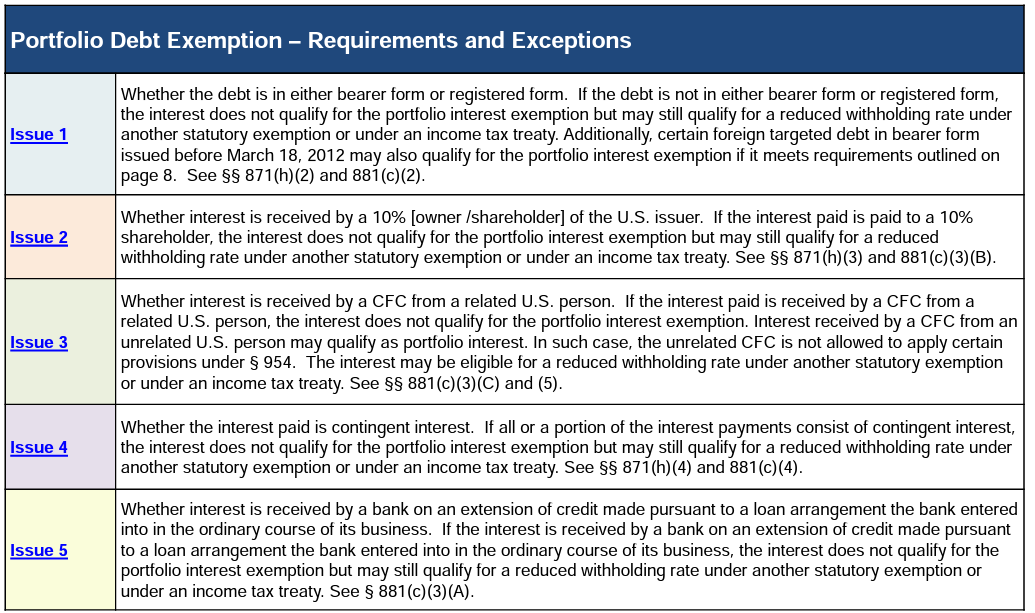

Portfolio Interest Exemption Advanced American Tax

Taxation Principles Dividend Interest Rental Royalty And Other So

Portfolio Interest Exemption Advanced American Tax

Chapter 5 Non Business Income Students

Portfolio Interest Exemption Advanced American Tax

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Public Provident Fund Investment Tips Savings And Investment

Taxation Principles Dividend Interest Rental Royalty And Other So

Not Disclosed Interest On Fd Bank Savings Be Ready For Income Tax Dept Notice Businesstoday

Taxation Principles Dividend Interest Rental Royalty And Other So

Chapter 5 Non Business Income Students

Taxation Principles Dividend Interest Rental Royalty And Other So

Personal Income Tax Interest Income Tax Treatment

Deutsche Bank Fd Rates Fixed Deposit Interest Rate Calculator 2022

Portfolio Interest Exemption Advanced American Tax

Taxation Principles Dividend Interest Rental Royalty And Other So

Mortgage Rates Canada Moneywise

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)